SAFE is an acronym for “Simple Agreement for Future Equity” that is concluded between the investors and the target companies/start-ups; where the investors give the funds to start-ups in advance, in exchange for a promise from the company to give shares to the investor at a future date when start-up raises money on a priced round (equity investment).

I. Understanding SAFEs

SAFE is an acronym for “Simple Agreement for Future Equity” that is concluded between the investors and the target companies/start-ups; where the investors give the funds to start-ups in advance, in exchange for a promise from the company to give shares to the investor at a future date when start-up raises money on a priced round (equity investment). It is possible for the start-ups to sign SAFEs with numerous investors at the same time or at different points with different valuation caps, as by nature, SAFEs let start-ups to reward investors who are willing to move first by taking more risk, with lower valuations.

SAFE has been introduced to start-up ecosystem as a funding vehicle in 2013 by Y Combinator, an American technology startup accelerator which successfully incubated more than 3000 start-ups including; AirBnB, DoorDash, Dropbox, Twitch and Reddit. SAFE is mostly a simple standardized agreement

1 and has been initially drafted by Y Combinator to replace convertible notes. It basically covers sections of definitions, triggering events, representations of the company and investor, and miscellaneous legal provisions.

SAFEs have been primarily structured to make calculations on “pre-money” as the investments made with a SAFE were not substantial at the time of its introduction and holders of SAFEs were merely early investors in such startup’s future priced round. Following the evolution of early-stage fundraising and increase of the popularization of SAFE in the start-up ecosystem, in 2018, Y Combinator have structured SAFE again to make calculations on “post-money” for clearance to both founders and investors to immediately see the full picture by giving them the ability to calculate precisely how much ownership of the company has been sold. This way the founders have the awareness on how much portion of their ownership is relinquished and how much dilution is caused by such sale, while the investor knows from the beginning how much ownership of the start-up he gets for his investment.

As mentioned above, SAFEs are still evolving since the day they have been created to provide; faster, simpler and more efficient ways to gather the investors and start-ups by especially avoiding red tapes.

II. How do SAFEs work?

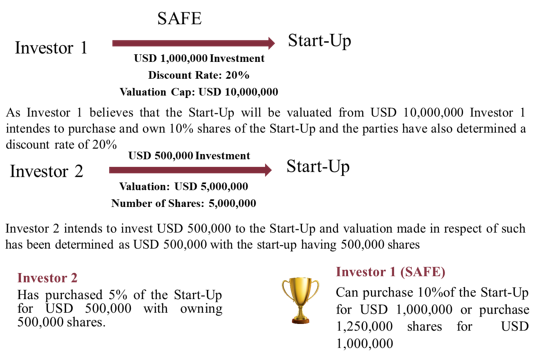

Once a SAFE has been concluded between the investor and the start-up, the investor gets a financial stake in the start-up which actually is a contractual right to be converted into shares once the pre-agreed event in SAFE triggers the conversion. Accordingly, the pre-agreed event triggering the conversion of SAFE to a share in the invested start-up is known as the “trigger/ing event”. It should be noted that, the investor, even though making the payment in advance via SAFE, will not be obtaining any shares in the start-up until the agreed triggering event occurs, and the risk herein to the investor is that such trigger may never take place. Accordingly, the investor will not be granted with any rights upon signature of a SAFE, unlike a sale and purchase agreement or a subscription agreement which obligates a transaction between a buyer and a seller or the company as the case may be. While sale and purchase agreements or the subscription agreements are the most investor-friendly options for investing in a company, SAFEs are the most suitable option for the start-ups. SAFEs do not address the start-up’s current valuation and postpone it to the next round, by contrast in the sale and purchase agreements or subscription agreements, the investor buys shares in a company at the given price per share either from the seller or via subscription to the company.

Furthermore, SAFEs should not be confused as a “debt” instrument as interest rates and maturity/repayment dates could not be found in SAFEs. This way, SAFE becomes advantageous for start-ups as it does not accrue interest as a loan does.

Depending on the conditions set out by the parties and following the occurrence of the agreed triggering event -which might be future financing, acquisition, IPO or any other pre-determined event within the SAFE- the investor can choose (i) either to convert its investment into equity or (ii) to receive the investment back. If and when both parties agree to it, the investor and the start-up may also conclude a Pro-Rata Side Letter

2 as part of the SAFE investment, by which the investor shall have the right to purchase its pro rata share of standard preferred shares being sold in the equity financing, if a pro rata right to participate in the equity financing (i.e. the Series A, if the Series A is the round in which the SAFEs convert) is crucial for the investor to make its investment. As soon as the SAFE investment is converted into a company share, investor will have a pro-rata right to maintain its equity share by participating in subsequent financing round.

One should also bear in mind that since start-ups may sign numerous SAFEs with various investors, it may force the investor into a partnership with an unwelcome partner. Therefore, it is highly important to comprehend before conversion of the investment into shares, the current shareholding structure of the target start-up and existence of any other SAFEs executed by the start-up.

Also, SAFE does not grant any information rights on the start-up to investor. SAFE is created as a tool to help start-ups and investors to find each other with clarity and investors to invest in the start-ups that holds upmost potential with top-tier governance. Therefore, with concluding a SAFE the investor puts a good space between the parties, as SAFE does not grant control or information rights. SAFE impose a high risk for the investor depending on the success of the start-up. It should also be noted that there is always the risk of trigger event not occurring, and the investor is not entitled to claim/receive its investment back until the occurrence of the trigger event.

In line with the above introduction, there are 3 (three) crucial remarks regarding SAFEs as follows:

a. SAFEs are not stock certificates: Share certificates represent a person’s equity in a company and in this context, share certificates stipulate rights and obligations for the holder. On the other hand, SAFEs do not represent an existing stake in the invested company. Instead, the investor will be entitled to obtain such shares in the future once the requirements/conditions set out in the SAFE are met.

b. SAFEs are not prepared equally and should be thoroughly reviewed regarding trigger events: Although SAFEs are simple and standard as they get, start-ups could determine different triggering events in different SAFEs. Therefore, it is highly important to comprehend each condition set out in a SAFE. SAFE conversion can be triggered in the future by several different scenarios. For example, the acquisition or merger of a company by another company can trigger one SAFE, as well as another SAFE can be triggered by public offering of securities.

c. Triggering events found in SAFE may never occur : Despite the triggers pre-determined by the investor and start-up in a SAFE, such trigger event might never occur and thus prevent the SAFE from being converted into shares. Suppose the investor and start-up have determined an equity financing trigger as a means of raising capital, but if the company has enough income to increase its size and do not require any capital increase, the trigger might never occur and the SAFE cannot be converted into shares.

III. Common Types of SAFE

There are 3 (three) common types of SAFEs used by companies in US which are as follows:

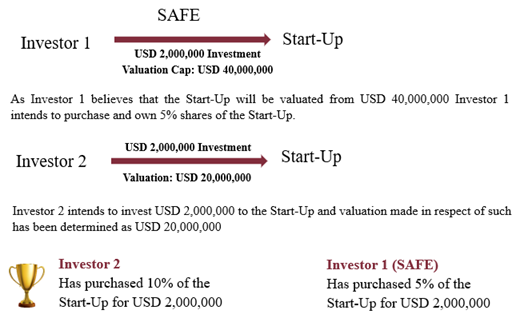

SAFE 1: Valuation Cap, No Discount

Valuation Cap, the most common one, is similar to one found in convertible notes, entitles SAFE holder to convert the SAFE into shares either at (a) the valuation cap or (b) the price of each share for equity financing, whichever is lower. Valuation Caps are beneficial for the investors if implemented to SAFE correctly. It should be noted that the valuation made by the investor should be made with the current projections or assets of the start-up. The main principle of Valuation Cap is to make sure that the investor inadvertently does not miss the best time of appreciation. Therefore, it would be highly beneficial for the investor to determine a well-balanced Valuation Cap, as the miss-calculation of the valuation would cause loss for both parties.

If the priced round is higher than the Valuation Cap, then the SAFE converts to the cap, which means that the SAFE holders basically get more shares for the same amount of money than the Series A investors get. Where the cap is higher than the priced round, it would not be fair for the SAFE holders to get a worse deal than the Series A investors, since they put money into the company earlier, hence they will calculate the shares based on the priced round price. This being said, it is pretty unlikely that start-ups raise priced rounds at lower valuation than that SAFEs.

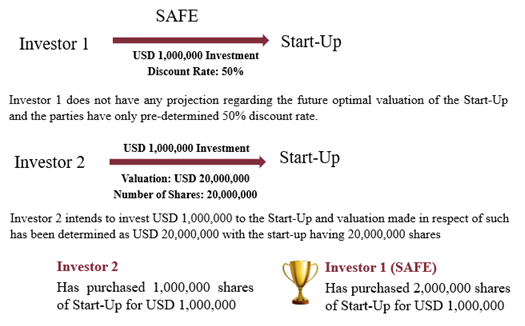

SAFE 2: Discount, No Valuation Cap

Discount price is the lowest price of preferred share offered in priced round multiplied by the discount rate determined by both parties.

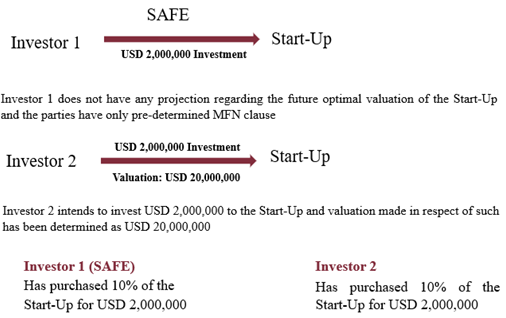

SAFE 3: MFN (Most Favored Nation), No Valuation Cap, No Discount

If the start-up issues any subsequent convertible securities with terms more favorable than SAFE (including, without limitation, a lower valuation cap and/or discount) prior to termination of SAFE, start-up will promptly provide the Investor with written notice thereof, together with a copy of such subsequent convertible securities, so that the first investor can benefit from the terms more favorable than its own SAFE.

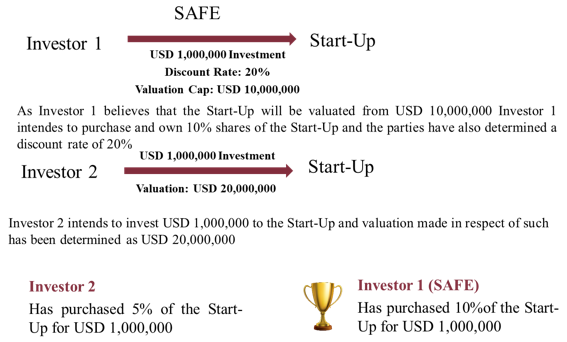

OTHER SAFES: Combined Models

It is important to note that there are other types of SAFEs which are not very common however can be used in different scenarios such as: (i) SAFEs with Valuation Cap plus Discount; which is not very preferable by the founders of the start-ups since they do not wish to sell their endeavors too cheap at the end of the day and (ii) SAFEs with No MFN, No Valuation Cap, No Discount, which is usually not preferred by the investors because investors naturally wish to receive some bonus/return of the lower price when their SAFEs convert, since they believed in the company and injected funds at a very early stage (incubation), therefore do not wish to be at the same position with the other subsequent investors on the priced round.

IV. Important Clauses in SAFEs

| Important Clauses in SAFE |

| Selecting the TYPE of SAFE |

- SAFE 1: Valuation Cap, no Discount

- SAFE 2: Discount, no Valuation Cap

- SAFE 3: MFN, no Valuation Cap, no Discount

or can be a combined version of the ones above.

This selection shall be reflected to the Preamble of the SAFE and it is the only section that differs the agreement from other SAFEs, as all other clauses shall remain the same in each SAFE, regardless of the type selection.

These fixed terms (below) are also the main reason why SAFEs are negotiated very minimally as everything is pretty standardized for both parties.

|

| Equity Financing |

- Equity financing means a bona fide transaction or series of transactions with the principal purpose of raising capital, pursuant to which the start-up issues and sells preferred shares at a fixed valuation.

- Equity financing being a trigger event enables the investor to convert the SAFE into shares in start-up by the investment divided to the lower one of (a) the valuation cap or (b) the price of each share for equity financing, whichever is lower.

- It is highly advantageous for the investor to determine a lower valuation cap if the start-up can be able to obtain higher equity financing.

|

| Liquidity Event |

- means a Change of Control, a Direct Listing or an Initial Public Offering

- Liquidity Event being a trigger event also enables the investor to convert the SAFE to either (a) the initial amount of investment made or (b) the amount payable on the number of shares of common shares equal to the investment divided by the liquidation depending on which is higher.

|

| Dissolution Event |

- means (a) a voluntary termination of operations, (b) a general assignment for the benefit of the start-up’s creditors or (c) any other liquidation, dissolution or winding up of the start-up (excluding a Liquidity Event), whether voluntary or involuntary.

- Dissolution Event being a trigger event also enables the investor to convert the SAFE to either (a) the initial amount of investment made or (b) the amount payable from cash and other assets of the start-up depending on which is higher.

|

| Liquidation Priority |

In a Liquidity Event or Dissolution Event, the Investor’s right to receive its cash-out amount is:

- Junior to payment of outstanding indebtedness and creditor claims, including contractual claims for payment and convertible promissory notes which are not actually or notionally converted into shares.

- On par with payments for other SAFEs and/or preferred shares.

- Senior to payments for common shares (founder’s or employees’ shares).

|

| Termination |

SAFE is automatically terminated if one of the pre-determined trigger events occur and the SAFE is converted.

|

| Miscellaneous |

- Neither SAFE nor the rights in SAFEs are transferable or assignable, by operation of law or otherwise, by either party without the prior written consent of the other.

- All rights and obligations determined under SAFEs will be governed by the laws of the selected state of United States of America.

|

V. Case Studies

SAFE: Valuation Cap, no Discount SAFE: Discount, no Valuation Cap

SAFE: Discount, no Valuation Cap SAFE: MFN, no Valuation Cap, no Discount

SAFE: MFN, no Valuation Cap, no Discount  SAFE: Valuation Cap, Discount

SAFE: Valuation Cap, Discount

* Either the Post Money Valuation Cap or the Discount Rate applies when converting these types of SAFEs into shares in an equity financing, depending on which calculation is most advantageous to the investor. (Discount Rate is not applicable in this study as Valuation Cap is more profitable. Whereas in the below study, Discount Rate is more profitable.)

VI. Conclusion

VI. Conclusion

Advantages that SAFE provides can be listed as follows:

- Standardized/relatively simple agreements speed up transactions,

- Lesser expenses due to decreased red tape/formalities,

- SAFE speeds up the negotiations as issues such as time, interest and guarantee are not discussed,

- SAFE allows the start-up to be in control of the shares it agrees to distribute to investors,

- SAFE process moves forward swiftly and without details, therefore SAFE vastly improves the possibility of start-ups to benefit from investors among different sectors and increases the opportunity to invest outside of the investor field of activity,

- SAFE prevents the shares of the investors from diluting against the other investors who are also investing during the triggering event, i.e at the time of the conversion of the SAFE, as the investor knows from the beginning, how much ownership of the start-up he gets for his investment.

Disadvantages coming with SAFE can be listed as follows:

- Since the determination of the Valuation Cap is very sensitive, an incorrect assessment can result in damage for both parties,

- Investors does not even have basic information rights to access company financials,

- There is a risk that the investor will not be able to get the investment back due to lack of control over the start-up, if the triggering event never occurs,

- The investment is a one-way ticket due to the untransferable nature of SAFEs,

- Founders residing outside the US can complicate the process and make it more difficult to implement.

It should not be forgotten that SAFE is specifically designed to aid the start-ups in the US to fund companies at very early stages. As explained above SAFE is a standardized agreement, having pre-determined conditions and definitions. However, if the investor wishes to obtain additional rights such as information and control rights, then SAFE is not a recommended method.

SAFE is only recommended to investors who has strong grounds to believe in start-up’s mission, like their product as well as their approach to the market and can escalate the possible future valuation of the start-up and willing to take the high-risk of losing the entire investment for the sake of it.

From the standpoint of an equity partner, KISS (“Keep It Simple Security”) which has similar features with SAFE (as it also aims to simplify and standardize seed funding for start-ups) can be a more preferable convertible security method than SAFEs, since it gives investors information and control rights over the start-up, can have maturity and accrued interest just like debt and, unlike SAFEs, KISS notes are transferrable to anyone.

In any event, before deciding to proceed with any particular transaction executed with one or more SAFE forms, we advise investors to obtain competent legal advice from an attorney licensed under the selected governing law jurisdiction in terms of (i) the impact as to possible inclusion of a clause into SAFEs allowing the investor to purchase his shares at a known price per share if the next round will not be completed by a given deadline, (ii) understanding any risks or difficulties that may be encountered in relation to the validity and enforceability of SAFEs in line with the precedent cases and (iii) understanding the intrinsic responsibilities imposed on the founders/startup, even though not written in the agreement, in order to be able to bring forward any claims if startup fails to comply with the same.

MORAL & PARTNERS

1 Please visit

https://www.ycombinator.com/documents to look at the standardized agreements.

2 Please visit

https://www.ycombinator.com/documents to look at the standardized side letter.